NFT Finance Digest #5: Mixed Feelings

Stay on top of NFT Finance every week: In-depth analysis, news, insights, and more on the exciting intersection of NFTs and DeFi

GM frens! Welcome to the 5th weekly edition of The NFT Finance Digest. This last week came with positive news as NFTFi starting Szn 1 program, Futures Market seeing more activity, but also, Paraspace facing a team dispute that is hurting users. To make things more spicy, Elon, as his own style, twetted about Miladies and pump them hard lmao

I’m on holidays this week so trying to go to the point on this edition, hope you can understand me :)

NFTFinance Ecosystem Status:

NFT Lending: Blur activity had been flat this week, Paraspace’s dispute hurt protocol

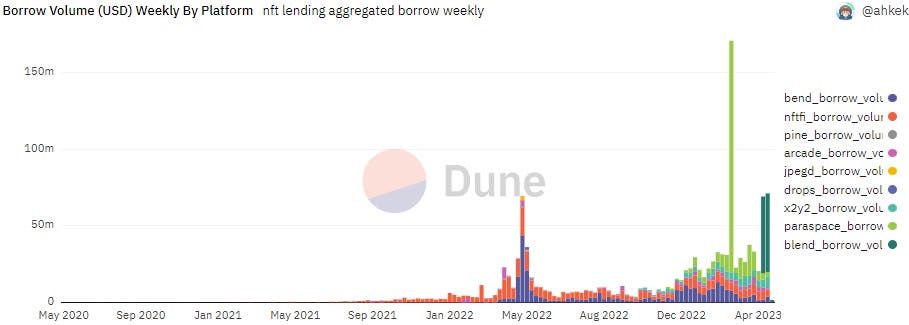

After Blur / Blend, the NFT lending market skyrockets:

Total Ecosystem Cummulative Volume has reached an ATH of $1.3Bn (+4% weekly growth), with weekly volume printing a new ATH as well

Why? BLEND is the one who is supporting much of this growth: So far, the Blur’s related protocol had originated a total loan volume of $58MM (5% of total historical volume), of which $51MM had been originated this week (50.5% of total Blend loans)

However, imo activity there is not growing as much: 2nd week daily volume & # loans similar to 1st w: flat at 6K ETH & 420 loans / day

@DeGodsNFT new listing had not drive much volume: 3.2K eth in loan volume (10% total) & 341 loans (13% total) so far

On Monday, Blend will add 2 new collections to the ones elegible. ¿What are your picks? Based on takes on the crypto street, Beanz and BAKC

On the “OGs” P2P segment, Arcade is the one seeing strong growth activity in the last weeks, with a +4% increase on weekly basis, with a total of $12MM in loans outstanding

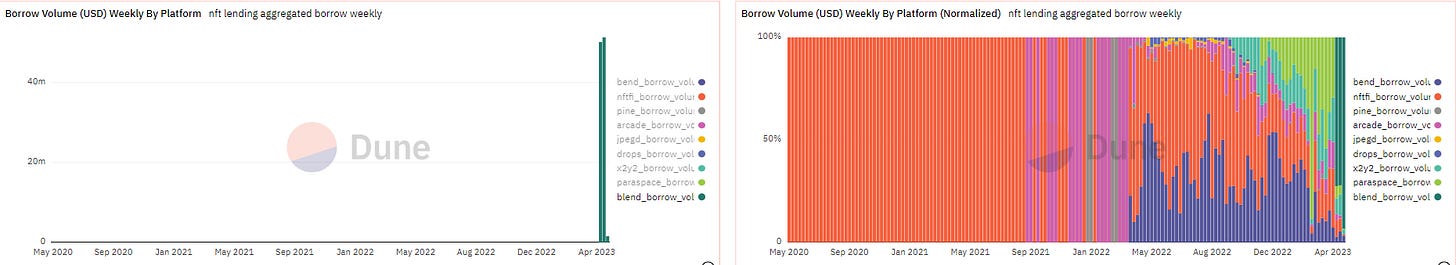

On P2Pool side of things, Paraspace - once the leader and high growing protocol in NFT Lending market - entered this las week in a dispute between team members & CEO. The results?

TVL Lost with +$130MM being withdrawn (-60% in a week)

Lending side - the biggest the last week- saw a 63% decrease with $100MM flying out the protocol

Collateral flewing away from Paraspace

APE Staking - probably one of best features of Para given its autocompounding - had experienced a withdrawn of $40MM

APRs at extreme high levels (2 / 3 digits) given the high utilization rates. Probably a good opportunity for those still providing liquidity but hurting borrowers a lot, more when consider the extreme gas fee levels given memecoins

Both sides have their arguments and side of the story, hopefully for the benefit of users and the overall nascent NFTFi vertical, they can reach an agreement with no much hurt to users and investors

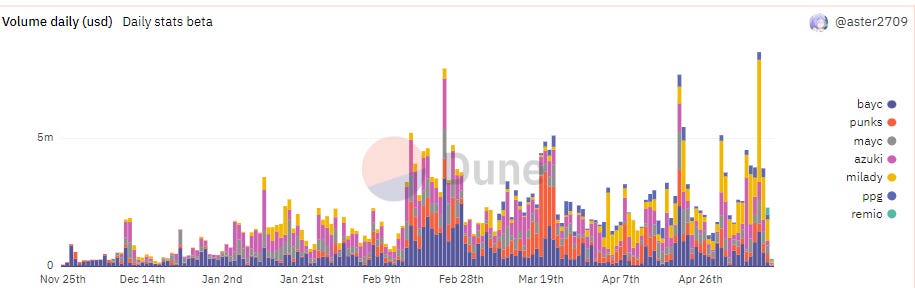

NFT Perpetuals: Elon did it again

Elon twitted about Milady, and floor pumps, with it, activity on NFTperp: + 7% weekly growth in metrics, and with NFT printing +50ETH in fees

So far:

+197K ETH in Total Volume

+2.3K users trading

88K trades

For the Miladys pair only: +1.2K trades (5x the average of the last 40d of trading) & $4.7MM in volume just on Elon's twt day…crazy? yes

On the other side of the Perpetuals market, @Tribe3Official is also seeing early signs of good traction, after being released to public beta less than 15days ago:

Volume: +1.2K ETH

Users: +150 (2x week over one week)

As we mention before, the project has a strong focus on providing a more social & gamified trading experience

On my radar:

NFTFi szn1 begins!

NFTfi will start today their Earn Szn 1, and with this prolly the begining of the #NFTFiSummmer🌴?

What you have to do? Use the platforms (as borrower or lender), based on your activity user will receive reward poitns. According to protocol, “larger loans and lower APRs may mean more points”

For context, NFTFi had done so far:

$400MM in cummulative lending volume

42K loans

With borrowers and lenders growing up and to the right on a monthly basis

Cross Chain NFT Futures, yes, you read it well

On Solana eco, After a 🔥paper trading season of Solana based NFTs, SujikoProtocol is opening perps futures trading for Ethereum & Polygon NFTs (BAYC, Azukis, PudgyPenguines, DeGods, Y00ts & MadLads as WLd collections

Important? Yes. Cross-chain perps are here = less $ to trade / get exposure to the collection, + users onboarded & Solana community so supportive w/ NFTFi project

NFPerp is doing nuts!

Nftperp is releasing Mafia Nuts for its Trading Szn 4. 1 500 ¿NFTs? divided in 4 families, of which 350 will be given to top 350 users by trading volume

Perks:

"- Guarantee entrance to most prestige trading venue

- Trading discounts

- More"

What a (crazy) week, not gonna lie! ¿Will Paraspace solve their issues this week? Will Blur adds more volume to its lending protocol?

Looking forward what exciting things will this week, in the meantime stay safe, and stay up-to-date with NFT Finance at the NFT Finance Digest

If you have any question, or feedback, or just wanna chat about the space please feel free send me a DM or write in the comments

Ps. Follow me on Twitter for real-time insights and opportunities